The Fraud tree-Financial Statement Fraud-Part-3

Occupational Fraud and Abuse Classification System

Source:“2020 Report to the Nations. by the Association of Certified Fraud Examiners ACFE

Contributed By By Alia Noor, FCMA, CIMA, MBA, Oxford fintech programme, GCC VAT Comp Dip,COSO Framework.

Associate Partner Ahmad Alagbari Chartered Accountants, UAE

Founder xpertsleague

Fraud Tree-Part- 3

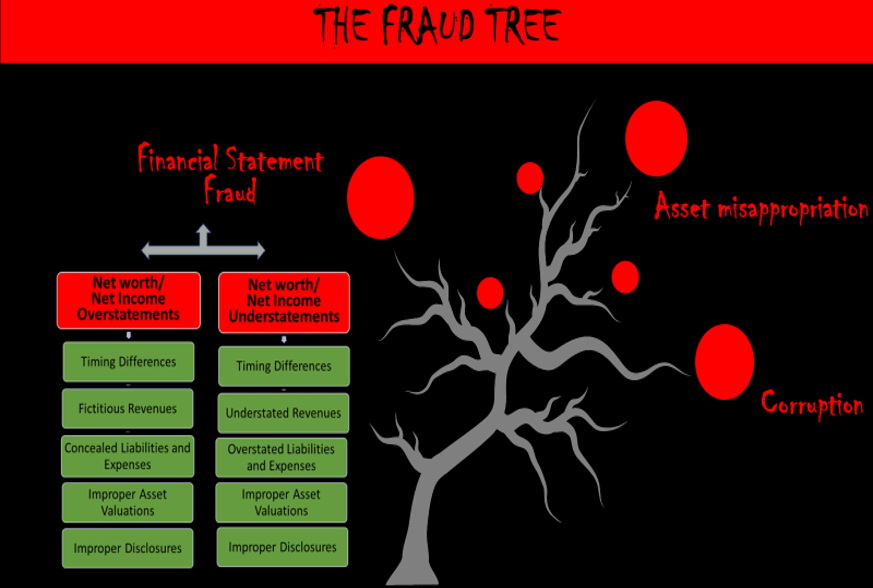

“Financial Statement Fraud”

Financial statement fraud usually involves overstating assets, revenues and profits and understating liabilities, expenses and losses. However, the overall objective of the manipulation may sometimes require the opposite action.

Financial statement fraud is the deliberate misrepresentation of the financial condition of an enterprise accomplished through the intentional misstatement or omission of amounts or disclosures in the financial statements to deceive financial statement users.

According to “2020 Report to the Nations“by the Association of Certified Fraud Examiners ACFE ,

- Financial Statement fraud schemes are least common (10% share) but most costly.

- Most Common Anti-fraud controls – Code of Conduct, Internal audit, statutory audit; these controls reduce both percentage loss and duration of fraud to 50%

- Primary weaknesses that contribute to occupational fraud – Lack of Internal Controls (32%), lack of management review (18%) Override of existing controls (18%)

- Occupational fraudsters who had been with their organizations at least 6 years caused TWICE the loss of less-tenured employees

- Perpetrators exhibit behavioral red flags – Living beyond means (42%), Financial difficulties (26%), unusually close association with vendor/customer (19%)

Red Flags of Financial Statement Fraud

- Slowdown for previously fast-growing company

- Industry changes

- Significant pressure to obtain additional capital

- Unusually high dependence on debt

- Significant, unusual, or highly complex transactions, especially close to year end

- Significant estimates involving unusually subjective judgments or uncertainties

- Significant high-risk investments

- Management incentives tied to unreasonable growth or profitability expectations

- Lax attitudes about regulatory requirements

- History of claims alleging fraud

- Lack of established policies or controls

- Lack of proper training

- Lack of enforcement of procedures

Tests for Financial Statement Fraud Schemes

▪ Financial statement analyses identify changes, trends, and significant accounts on the financial statements.

▪ Types of financial statement analysis:

- Horizontal analysis

- Vertical analysis

- Ratio analysis

“Corruption “-PART-2

As per 2020 Report to the Nations. by the Association of Certified Fraud Examiners ACFE , corruption — includes offenses such as bribery, conflicts of interest, and extortion—falls in the middle in terms of both frequency and financial damage. These schemes occur in 43% of cases and cause a median loss of USD 200,000.

click here for part 2:

https://www.xpertsleague.com/the-fraud-tree-corruption-part-2/#.X1-y4mgzY2w

“Asset misappropriation”- PART-1

which involves an employee stealing or misusing the employing organization’s resources, occurs in the vast majority of fraud schemes (86% of cases); however, these schemes also tend to cause the lowest median loss at USD 100,000 per case

click here for part 1:

https://www.xpertsleague.com/fraud-tree-part1-asset-misappropriation-fraud-schemes/#.X1yaVGgzY2x

- “𝐇𝐎𝐖 𝐓𝐎 𝐓𝐀𝐌𝐄 𝐘𝐎𝐔𝐑 𝐓𝐀𝐗 𝐃𝐑𝐀𝐆𝐎𝐍” - January 24, 2024

- Generative AI: A powerful tool for CEOs - January 19, 2024

- The Next Wave of Finance Digital Transformation: Unlocking Potential in 2024 - December 7, 2023

Hi you do a great job thanks to you for that