IAS 32 “Financial Instruments: Presentation”

By Adil Khan

Manager Audit and Assurance Services,Mazars Abu Dhabi, UAE

The fact about the financial instruments complexity relating to presentation, recognition/derecognition and measurement of financial instruments, i encountered number of instances, when the Company faces impediment for appropriate presentation of financial instruments, which i assume is easy and should be on finger tips, principally when it comes to the audit team.

Being said this, we know that most medium sized firms’ clientele does not have complex financial instruments, like warrants and derivatives, however, basic financial instruments presentation knowledge is required at almost all level.

IFRSs focus on financial instruments through three different IFRSs, which covers the area of the most complex IFRS – financial instruments. These are below:

– IAS 32 Presentation of Financial instruments

– IFRS 7 Financial Instruments: Disclosures

– IFRS 9 Financial Instruments

IAS 32 knowledge is required more particularly when it comes to the presentation of financial liabilities and equity instruments. IFRS 9 covers mainly financial assets part.

This article covers the basics of financial instruments, because financial instruments can be quite confusing, and we need to explain first clearly what they are and how to present them in the financial statements of our clients’ financial statements.

This article covers key parts of IAS 32, in presentable manner in order to receive the core idea about financial instruments presentation.

1-What is Financial Instrument

Financial Instrument is a contract that gives rise to financial asset of the one Company, and financial liability or equity of another Company.

2-Categories of Financial Instruments?

Below are the financial instruments categories:

– Financial assets

– Financial liabilities

– or Equity

Financial Assets:

Financial assets contain 4 broad things as below:

1. Cash (this is the simplest form, meaning all cash in hand (including petty cash), bank accounts and other cash equivalents).

2. Investments in shares this must raise question in your mind about investment in subsidiaries or investment in associates?

Would that be classified under financial assets and are covered by the IAS 32 as these by its legal form are investment in shares by definition, the answer is simple which is:anything which is specifically covered by the other standard will account for accordingly.

Hence when investment in shares are more than 50% would fall under IAS 27 Separate Financial Statements and IFRS 10 Consolidations. Similarly, Investments made in between 20% to 50% in shares of another company would fall under IAS 28, Investments in Associates and Joint Ventures.

Note:

However, in some cases, IFRS 10, IAS 27 or IAS 28 require or permit an entity to account for an interest in a subsidiary, associate or joint venture using IFRS 9; in those cases, entities shall apply the requirements of IAS 32.

Long story short, any investment which is also called (trade investment) in shares less than 20% would be treated as investment in shares and would fall under IAS 32 and should be classified as financial assets.

3. Contractual rights to receive (in easy terms, any deal on credit would raise to contractual rights to receive below),

- cash

- another financial asset from another company

- potential favorable derivates

Therefore, all transactions made on credit which generates cash, or entitles the Company to receive financial asset from the counter party.

4. Settlement in entity’s own equity instruments

A contract in which an entity is or may be obliged to receive variable number of entity’s own equity instruments. For examples, an entity can agree with counter party to receive the shares of counter party in respect of outstanding receivables to settle the due from balances outstanding in their books. Such transactions should fall under financial instruments and should be treated as financial assets in the books of one company and financial liability in other (counter party).

Financial liabilities:

Financial liability is;

1. the contractual obligation to deliver (pay)

– cash

– another financial asset

– potentially unfavorable derivatives

If an asset is classified as financial assets, on the other hand it would be classified as financial liability or equity instrument in the contra party books.

2. A contract in which an entity is or may be obliged to pay variable number of entity’s own equity instruments. For examples, an entity can agree with counter party to issue the shares to counter party in respect of outstanding payables to settle the due from balances outstanding in the books.

Equity Instruments:

An equity instrument is a residual interest in the assets of an entity after deducting all its liabilities. (Equity = Total assets – Total Liabilities).

Equity instrument is the entity’ OWN equity and it may include not only shares but warrants, options and other instrument.

3-How to Present Financial Instruments

One rule of IAS 32 is to classify the financial instruments on initial recognition as a financial assets, financial liability, or equity instruments.

Substance over the legal form plays very important role in measuring the financial instruments, I personally feels audit team shouldn’t see it a big deal while classifying financial assets, but audit team (or entity itself) could face challenges to distinguish between financial liability and equity instruments.

LET’S MAKE IT MORE SMOOTH FOR UNDERSTANDING PURPOSE!

Care is required by the audit teams to assess if there is a contractual obligation to deliver cash/financial assets?!

If Yes, then the instrument is a financial liability.

If No, then the instrument is an equity instrument.

Take an example, if an entity has issued redeemable preference share, the legal form of the instrument is share but the entity has an obligation to pay (fixed amount of dividend). The economic reality of the transaction should be cover under IAS 32 as financial liability and not equity instrument.

IAS 32 further stress on a terminology called “CONTINGENT PROVISION”. It says, where there is a technical doubt created in classifying financial liability or equity instruments or if the transaction is made contingent depending on the happening or non-happening of an event, the instrument must be recognized as financial liability.

However, despite of the CONTINGENT PROVISION, IAS 32 also uses a terminology called, “NOT GENUINE”. It means, in case of issuing equity instruments in case the contingency provision in the contract is IMPRACTICABLE (Not Genuine), in other words if the condition in the contract is [Increase of Abu Dhabi Stock Exchange from 10,000 Index in current date to 200,000 index within a year]. This would never happen, and the transaction would be treated as equity instrument (not financial liability as said above).

Lets’ kick the discussion to the difficult part of the definition “transaction in own equity”.

Equity instrument includes no contractual obligation to deliver variable number of equity instruments or an instrument that can be settled only the issuer exchanging a fixed amount for a fixed amount of its own equity instruments.

Simply, we should be careful about the two facts below for better understanding.

1. Are equity instruments own or issued by somebody else?

2. Is the amount to deliver is fixed or variable?

Let me discuss with you few examples:

Example # 1

Audit team have seen that the Company A (audit client) has sell an option to deliver 100 shares of Google to Company B. This is a financial liability, because the shares are NOT YOUR OWN shares. They are shares of somebody else (Google in this case).

Example # 2

Audit team have seen that the Company A (audit client) has sell an option to deliver their own shares in total value of USD 100 to Company B. This is a financial liability, too, because although the shares are Company A, their number is variable. Why??? Because the exact number of shares will depend on the current price of the share at the delivery. Audit team will calculate it as 100 divided by the market price of one share.

Example # 3

Audit team have seen that the Company A (audit client) has sell an option to deliver 100 pieces of their own shares to Company B. This is an equity instrument, because the shares belong to Company A and their amount is fixed – 100.

4-Compound Financial Instruments

One of the key elements of IAS 32 is the compound financial instruments.

In some cases where an entity issues a financial instrument which contains the component of both financial liability and equity.

Easy example is: Convertible bond!

If an audit team seen that an entity has issued during the year a convertible bond, audit client provided holder an option to get the bond repaid by some number of the ordinary shares of issuer instead of taking cash at time of its maturity.

Let me brief you here with a simplified example:

Company A normally issues bond USD 10,000 at 5% rate of interest (market rate of interest). However, they decided to issue bond with the convertible option to the ordinary shares of the Company, since it has provided a holder an option to convert (an extra benefit/privilege to become the shareholder), they would release the bond at low rate of interest, let say 3.5% (less than 5%). The difference of 1.5% is due to conversion option.

In such case an issuer needs to classify and present these two elements separately:

– The loan element is presented as a financial liability, and

– The call/convertible option element is presented as an equity instrument.

I would explain the above with an example to simplified it more and to show how separation is made in case of compound financial instrument:

Example:

Suppose your audit client has issued 2,000 convertible bonds at the start of year. The bonds have a three-year term and are issued at a face value of USD1,000 per bond, giving total proceeds of USD 2,000,000. Let us assume that the Interest is payable annually in arrears at a nominal annual interest rate of 6%. When the audit team scrutinized the contract, it states that each bond is convertible at any time up to maturity into 250 ordinary shares. When the bonds are issued, the prevailing market interest rate for similar debt without conversion options was 9%.

Answer:

Audit team should measure the liability component first and calculate the difference between the proceeds of the bond issue and the fair value of the liability is assigned to the equity component.

The present value of the liability component is calculated using a discount rate of 9%, the market interest rate for similar bonds having no conversion rights, as shown below.

The PV of the principal – USD 2,000,000 payable at end of 3 years = USD 1,544,376

The PV of the interest – USD 120,000 payable annually in 3 years = USD 303,755

Total liability component = USD 1,848,122

Equity component (by deduction) = USD 151,878

Proceeds of the bond issue = USD 2,000,000

5-Offsetting a Financial Asset and a Financial Liability

Offsetting means presenting a financial asset and a financial liability as one single net amount in the statement of financial position.

One of the key elements described under IAS 32 is the offsetting of a financial asset and a financial liability. IAS 32 has allowed to offset both subject to some rules:

To comply with the standard, audit team must ensure below:

– When audit client has a legally enforceable right to set off the recognized amounts, and

– When audit client intends to settle on a net basis or realize the asset and the liability simultaneously.

I would like to illustrate above with few examples:

Example:

Imagine your audit client run a supermarket and they buy goods from a local producer. They purchased some goods and have a liability of USD 1,000 but let us assume that they also charged promotion fees amounting to USD 50 to their supplier, because they issue a leaflet and include his products there.

So, at the same time, the audit client has a receivable of USD 50.

Hence they can present these two items as a net financial liability of USD 950, if there are no legal restrictions to do so and if audit client agreed with the supplier somewhere in the contract that you would make net payments.

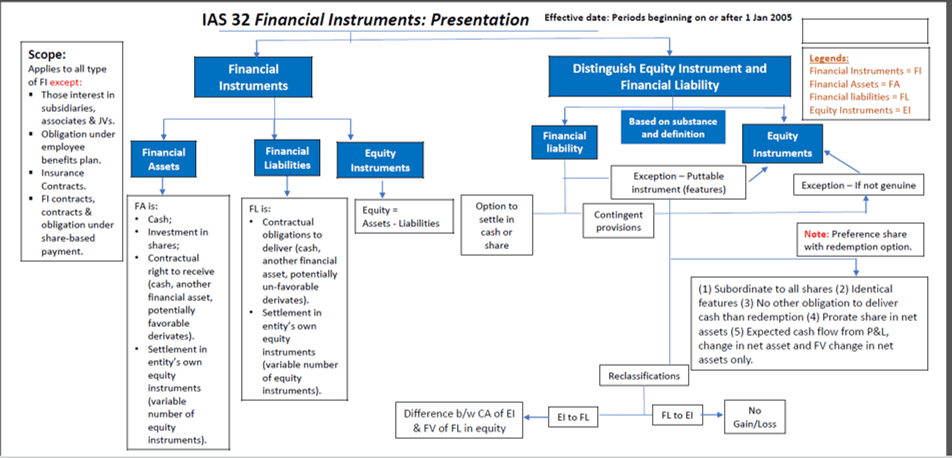

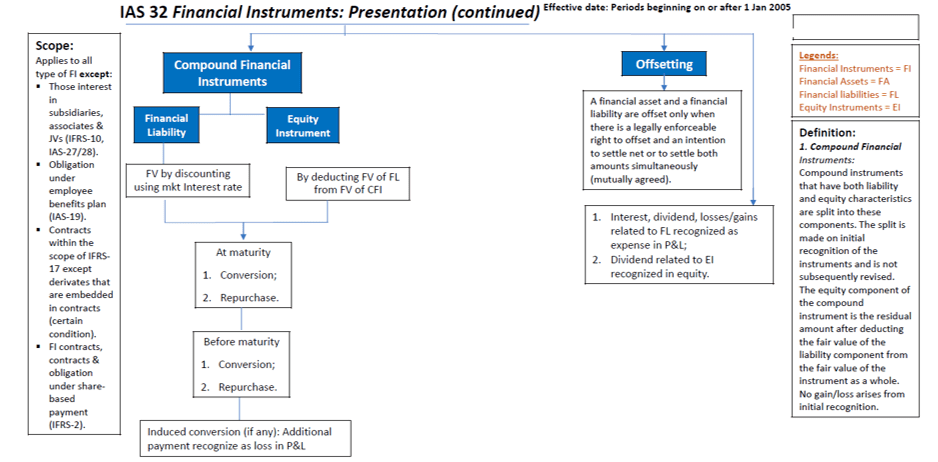

BELOW IS AN EXTRACT OF THE IAS 32 from thee IFRS Glimpse (IG) published by my-self for the high level overview and understanding.

- Board Reporting Software – Best Practices for Writing a Board Report That Resonates With Members - July 24, 2024

- What Are Data Rooms? - July 21, 2024

- Board Portals for Meetings - July 17, 2024

Stay connected