Are Cryptocurrencies a bank´s business? Oh Yes!

By Prof. Dr. Carsten Bartsch, Germany

Managing Partner of DB&P

July 22,2020 will always be remembered as a historic day in both US banking

as well as in the growing crypto ecosystem.On this day, Senior Deputy Comptroller

and Senior Counsel Jonathan Gould issued a public letter noting that any national

bank can hold onto the unique cryptographic keys for a cryptocurrency wallet, clearing

the way for national banks to hold digital assets for their clients.

Cryptocurrencies have long been seen as a kind of alternative monetary system – alternative to banks and alternative to central bank issues fiat currencies now this scenario is significantly changed.

This is an door opener to a new era in US banking – also setting an example for many other banking markets. Showcasing a pro-crypto stance and moving the industry one big step forward, the OCC has made it easier for other, more cautious regulators to follow suit (similar regulation is currently being developed in Germany – likely setting precedence for the entire EU).

Why has this step been so important?

In the context of crypto-banking, crypto assets or private cryptographic keys are also financial instruments. They are defined as digital representations of a value.

However, in the past, there always were two key problems for banks in dealing with crypto:

- Cryptocurrencies do not have the legal status of a currency or money, since their value is NOT issued or guaranteed by any central bank or public authority.

- There was simply no regulation on how banks could possibly deal with these non-monetary values.

Cryptocurrencies and alternative payment mechanisms enjoy very little trust by large groups of investors, since they have long been abused by shady players of the financial system – partially because of weak KYC measure by some exchanges.

Nevertheless, cryptocurrencies have always been suitable to do just the same job as classic fiat currencies can. They can be used by natural or legal persons based on an agreement or actual practice as means of exchange or payment. They can also serve investment purposes, and can be transmitted, stored and traded electronically.

Overview of Cyrpto Market

Covid-19 crisis led to a sharp rise in the trading volume of cryptocurrencies. According to recent Forbes article by Ron Shevlin (July 27, 2020) ,examined the developments in the cryptocurrency markets and came to conclusions that it look promising at first sight – but also pinpoint to the work left to do to achieve a widespread acceptance of cryptocurrencies.

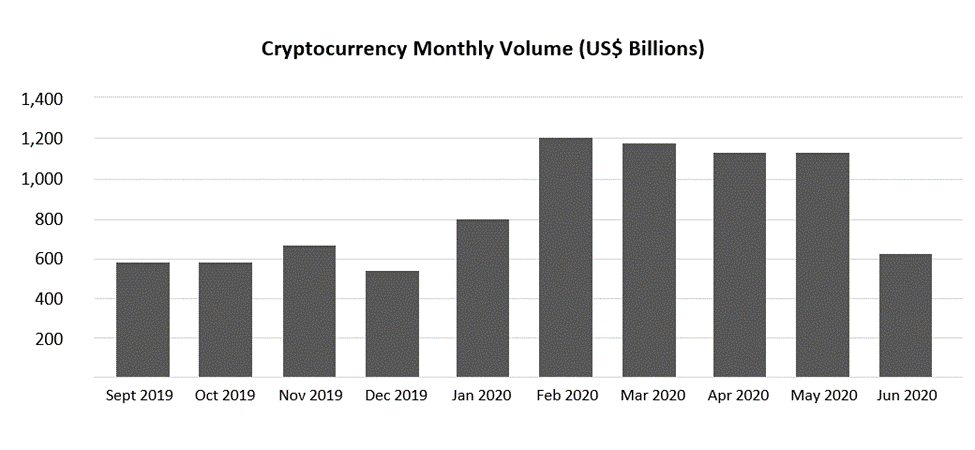

Trading of Bitcoin, Ethereum, and other cryptocurrencies increased sharply at the beginning of 2020, then jumped to a new high in February—a level that was sustained for the height of the Coronavirus crisis from March through May.

Cryptocurrency Monthly Trading Volume SOURCE: CRYPTOCOMPARE

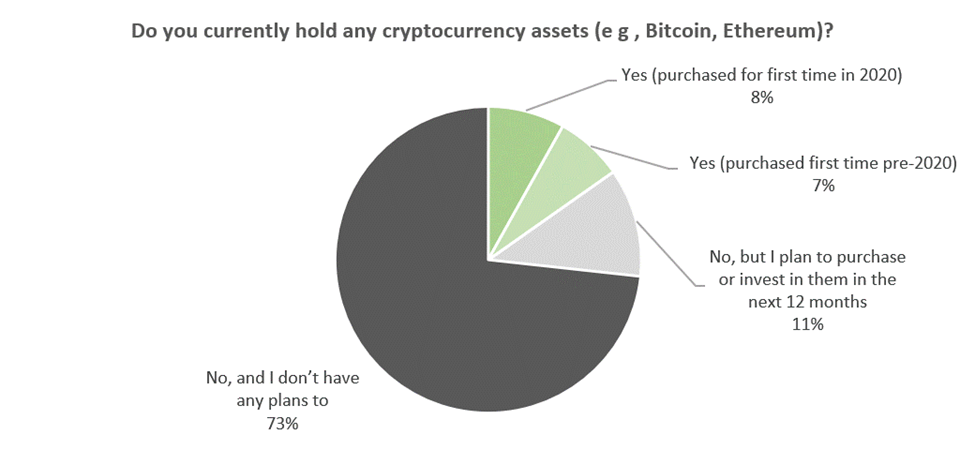

Another Forbes, a new study from Cornerstone Advisors revealed that 15% of American adults now own some form of cryptocurrency—a little more than half of whom invested in cryptocurrency for the first time during the first six months of 2020.

On average, these new investors obtained roughly $4,000 per person, whereas the self-reported value of cryptocurrencies (like Bitcoin, Ethereum) for Americans who owned these assets prior to this year is close to $7,000 per person. However, the Cornerstone Advisors study also shows that a vast majority of Americans, 84%, still do not own any kind of Cryptocurrency with most having currently no intention to do so (73%)

This acceptance rate is certainly alarming for an industry that is looking to finally grow out of being a niche market within the financial industry! Why do more than ¾ of consumers still shy away from cryptocurrencies? One reason might be that for the majority of the market, cryptocurrency still equals Bitcoin (BTC). And a closer look at Bitcoin might shed some light into the market´s skepticism.

Dark Side of Cryptocurrency Industry

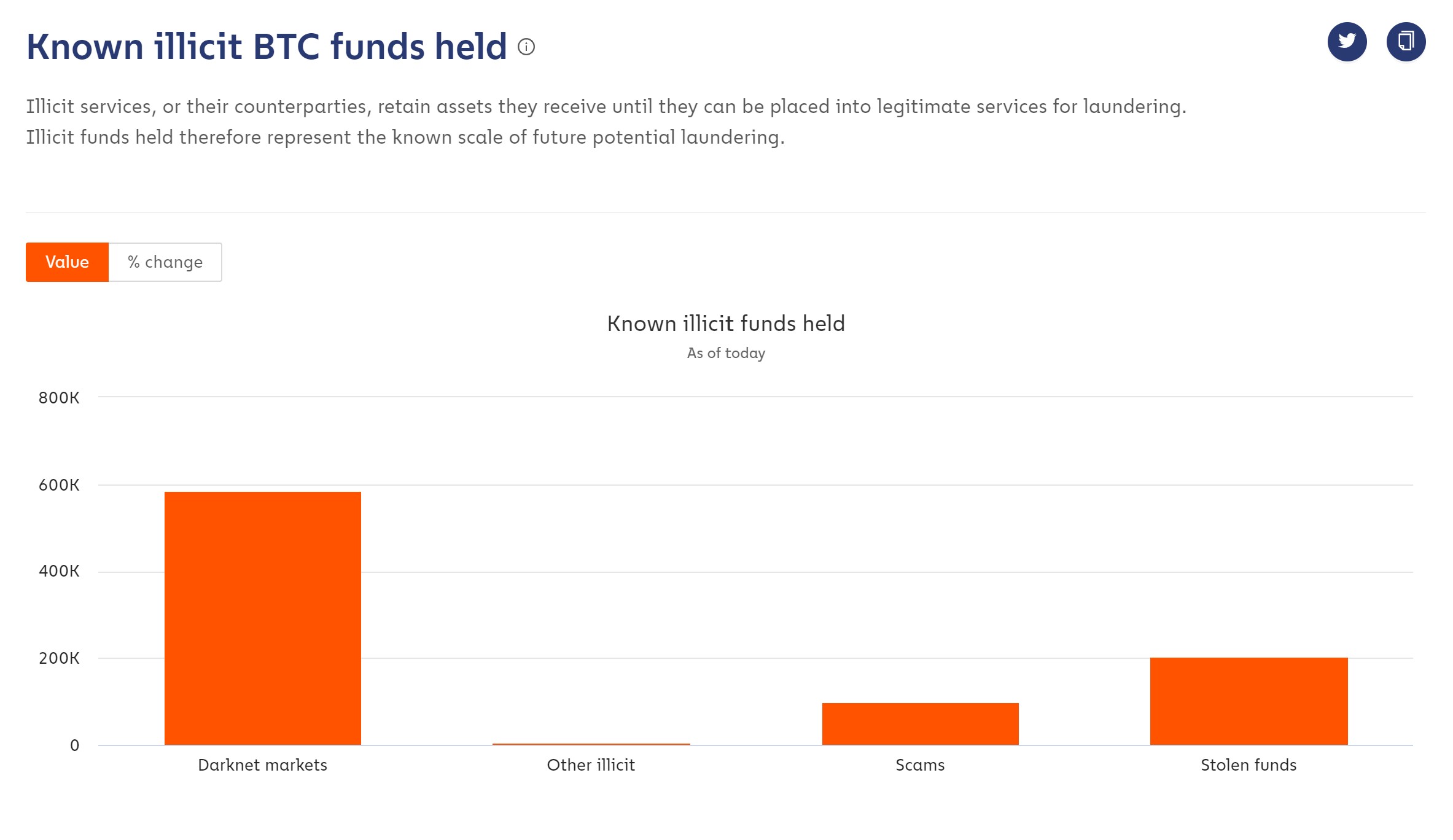

According to a recent study by Chainalysis,

Almost One million Bitcoin is being held by illicit actors with over half being held by darknet markets.

Darknet markets are currently estimated to have 585,000 BTC in their possession, scams 99,000 BTC, and stolen funds make up another 205,000 BTC.

Together with some 3,000 BTC involved in other sorts of illicit operations, this totals an estimated 892,000 BTC.

Just to put that into perspective – given the current price of roughly US$ 12,000, we are talking about a 12 trillion-dollar amount which is being held by shadow players of the financial system, mainly of the dark side of business

But what’s the starting point of this phenomenon that negatively impacts the entire cryptocurrency industry?

It´s the crypto exchanges, where this money is being placed and oftentimes involved in money laundering and other types of illegal financial transactions. We all know the stories of victims of ransomware being forced to pay (and doing so) to BTC wallets of undisclosed owners with more or less creative fantasy names.

According to a recent report from Deep Instinct,

it is estimated that in 2019 alone, a total global damage of US$ 11.5 billion was created by ransomware with the average cost of a ransomware attack having gone up to US$ 141,000 from US$ 46,800 in the previous year

And the reason for this is always the same – many of the existing exchanges built their business exactly for this clientele – a clientele that wants to store funds with undisclosed identities. Often from shady sources or simply to use bitcoin as a sort of online casino gambling given the high volatility of the market.

And therefore, many of the crypto exchanges haven’t taken their “Know Your Customer (KYC)“ and “Anti-Money Laundering (AML)“ procedures too seriously for quite some time. Though many of the premier crypto exchanges now require KYC, the stigma still persists in the public’s consciousness – as do these sins of the past in the form illicit funds/wallets in the crypto exchanges.

The OCC decision is now most likely to have an enormously positive impact on the cryptomarket.

Given the existing regulation PLUS the ability for banks, as trusted and widely accepted intermediaries, to actively enter the crypto-market on a large scale, the main barriers investors faced to move into the crypto market have fallen, resulting in investments into cryptocurrencies increasing significantly.

Given this banking revolution, banks now need a new type of infrastructure.They must

be able to hold, store or transmit cryptographic assets that are being kept, managed

and secured for others, which until this point banks could not legally do inside the US.

Crypto custody can be defined as cryptographic assets or private cryptographic keys being stored on behalf of a client. Up to now, banks have mostly been hesitant to get involved with cryptocurrencies due to their murky legal status – JP Morgan being the notable exception. However, now that the regulatory framework is clear, they are ready to make the jump. A jump for which they have no infrastructure in place so far though.

Based on the OCC decision, a massive inflow of investment is to be expected into the cryptocurrency market. Banks can now become players, but most probably not without the collaboration with Fintechs providing the turn-key platforms for a field of business, most banks have little to no experience in.

And this is where Fintechs come into play as the enablers for banks´entry into the cryptsphere! A vast majority of the 5,000 banks and credit unions in the United States will look to advanced Fintech companies, to support the deployment of cryptocurrency custodial services.

- Are Cryptocurrencies a bank´s business? Oh Yes! - September 1, 2020

- The implosion of a Fintech superstar – the case of the German wirecard - July 13, 2020

Stay connected