Are you Weaving Digital Mindset!

By Alia Noor, Associate partner, Ahmad Alagbari Chartered Accountants, UAE

Is it Exciting? …No! It’s interesting! What’s exciting is What can I do with this technology!

World is changing profoundly and quickly…

Information is king in today’s world ! where competitive advantage is carved by data and its interpretation. Data analytics providers are locked in heated competition over data which would yield valuable insights for crucial decisions.

Advanced robotics , artificial intelligence blockchain are the leading examples of the most disruptive technologies in today’s world.

Artificial intelligence has gone from a science-fiction dream to a critical part of our everyday lives we use AI systems to interact with our phones through Siri and Alexa . Amazon monitors our browsing habits and intelligently serves us up products it thinks we’d like to buy even Google decides what kind of search results to give us.

There is no area of business, society or life which technology is not upending. leveraging new technologies requires a paradigm shift. It requires organisations and professionals to rethink of their roles….

lets have a quick review….

Innovation is not restricted to a new technology, a new service offering, or a new strategy. It is the creation and delivery of new value to consumers and companies (PwC). Innovation requires not only an idea, but also action that will lead to the idea being implemented.

With Rise of Technology Organizations needs to keep up with change and require new business models and need to adopt the innovation process, develop an innovation culture & innovative ideas to disrupt markets.

IMPACT OF AI & BLOCKCHAIN ON FINANCE & ACCOUNTING

“Artificial Intelligence is the application of computer algorithms to task automation, often in a way that mimics how a human might respond to or manage a process”.

As digital technologies continue to disrupt industries and markets, the Finance & Accounting Function need to transform and create their digital roadmaps to leap competition.

AI will optimize or transform nearly every activity in finance. Finance leaders should be aware of how this will affect their function, prepare their team with new skill sets and explore the investments necessary to deploy AI.

The expectations of Finance have changed, tomorrow’s Finance and Accounting Function will focus increasingly on planning, analytics, and advisory role. The CEOs and the board are looking for leaders who think outside the traditional role of accounting, controlling, and budgeting and CFOs need to dedicate more time to strategic leadership, organizational transformation, and performance management.

Artificial intelligence (AI) and machine learning are leading to the development of a robotic accounting department (RPA), which is driving efficiency and consistency by applying business rules to eliminate high-volume tasks like reconciliations, automating many standardized processes and procedures, monotonous and repetitive task like approving loans, managing assets, assessing risks, accounts payable, accounts receivable, data entry and analyzing tremendous amount of data etc.

But this doesn’t mean “End of Finance Profession”,

Rather it will drive “Evolution of Finance Function”.

Finance and accounting functions need to transform from back-office function positions that revolve around preparation of figures the typical ‘Bean-Counter’ role to “Business Strategic Partner” by providing real-time insight instead of historical data enabling management to pivot quickly to meet customer demands and grab new opportunities before the competitors.

Develop new skills by embracing the power of technology, ability to understand how to apply new cutting-edge technologies like robotics, AI ,automation, and analyze data in real-time by applying data analytics.

Learn new skills and move more to business insight, risk management, cost controls and strategic advisory roles and adapt the pace of change to survive.Finance will have a greater opportunity for value added services as non-value added tasks will be automated or eliminated.

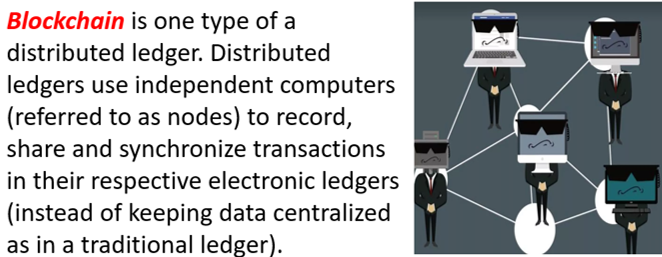

“Blockchain is a decentralized ledger of transactions across a peer-to-peer network which cannot be changed, tampered with, or lost due to blockchain’s decentralized and distributed nature. The blocks in a Blockchain consist of digital information (“block”) stored in a public database (“chain”).”

Blockchain invented over a decade ago as a public transaction ledger of the cryptocurrency bitcoin in 2008, is ready to unleash a wave of innovation across every industry and sector. When combined with Big Data, Artificial Intelligence and Human Expertise it opens up a huge range of possibilities.

Blockchain application has the potential to move the function from retroactive analysis and historical financial information gathering to a position where transactions can be recorded in real-time and may allow earlier collection & oversight through digital data.It could streamline and accelerate business processes,increase the speed, accuracy,collection of data, improve cyber security, and reduce or eliminate the role of intermediaries.

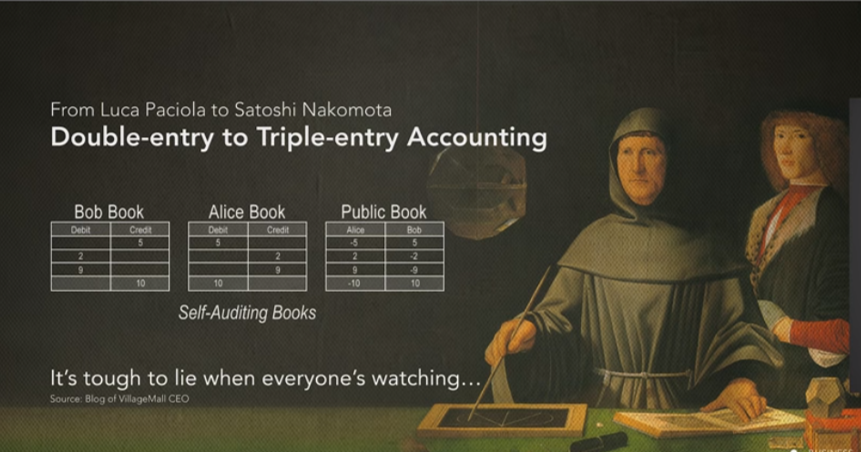

“Luca Pacioli” ,”The Father of Accounting and Bookkeeping” published work on the double-entry system of book-keeping wheras “Satoshi Nakamoto” devised the first blockchain database with Triple Entry accounting on blockchain.

In traditional books of accounts customer and vendor each keeps ledger related to the transactions between them under double entry accounting. Whereas in blockchain there will be triple ledgers accounting , third ledger known as public ledger (blockchain) where all the transactions are recorded .

In blockchain model transactions at all places are identical and connected and any misrepresentation or errors can be identified easily , eventually it reduces the need for validation or audit.

DIGITAL IDENTITY AND DATA PRIVACY

In this digital age, where consumers are increasingly embracing the Internet to perform online transactions for shopping , trading and online banking across multiple devices ;data privacy and digital identity in the cyber world has gained paramount importance.

Covid-19 has greatly impacted on how we live, work, and play. Overnight, our homes have transformed from a family space to our office, health clinic, retail store, school, theater, gym, and bank.Today, hundreds of millions of people are staying at home, transacting remotely, and embracing digital services.

The adoption of digital identity gives rise to privacy concerns, whether regulatory GDPR or consumer driven.

Decentralized identity models based on Blockchain technology has features to enable data to be maintained in an encrypted, immutable manner, and secured through cryptography, keeping the ID protected and traceable. Affixing the digital signature to all transactions carried out by the user makes it foolproof as well.

Users can have control of their identities while providing one-touch access there will be no need for Individuals to have seprate accounts for different providers , nor will they need to share their data every time they sign up for a new service.

In times of change, those who are open to learning will take over the future, while those who think they know everything will be well equipped for a world that no longer exists.

Stay connected for more Articles!!

- “𝐇𝐎𝐖 𝐓𝐎 𝐓𝐀𝐌𝐄 𝐘𝐎𝐔𝐑 𝐓𝐀𝐗 𝐃𝐑𝐀𝐆𝐎𝐍” - January 24, 2024

- Generative AI: A powerful tool for CEOs - January 19, 2024

- The Next Wave of Finance Digital Transformation: Unlocking Potential in 2024 - December 7, 2023

Stay connected