Bitcoin – Gold of the Future – Update July 2020

By Frank Schwab, Germany

Strategic Advisor, Speaker,Board Member at Gulf International Bank and at PayU, Co Founder FinTech Forum

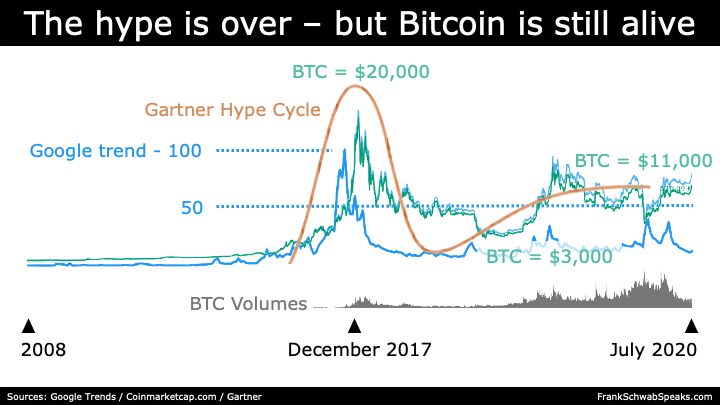

Since peaking at just under $ 20,000 on December 17, 2017, Bitcoin has lost more than three-quarters of its value. In January 2019, the price was a little over USD 3,000. And in July 2020, it already recovered to USD 11,000.

According to Google Trends, the internet community lost more than 80% interest after December 2017. But in the past few months, internet media interest in Bitcoin has increased significantly.

In Gartner Hype Cycle terminology: After a “Peak of Inflated expectations” in December 2017, Bitcoin plummeted into the “Trough of Disillusionment” in the following two years and is currently on the “Slope of Enlightenment”.

In his white paper “Bitcoin: A Peer-to-Peer Electronic Cash System” from 2009, Satoshi Nakamoto (pseudonym) introduced Bitcoin as an Internet payment system. But it doesn’t look like that at the moment, despite increasing Bitcoin wallets.

There are now more than 50 million bitcoin wallets and around 10 million new ones are added every year. But usage is not growing accordingly. For four years, the daily confirmed Bitcoin transactions have fluctuated between 200 and 400 thousand a day.

Bitcoin is therefore far from being a payment system, but much more a digital asset. Projects like PayPal, Facebook’s Libra or Ripple seem to be more promising in the fight for global payments.

“Bitcoin is a first of its kind – a digital asset & for me the gold of the future.”

Therefore, a comparison between Bitcoin and gold is worthwhile to take a look into the future.

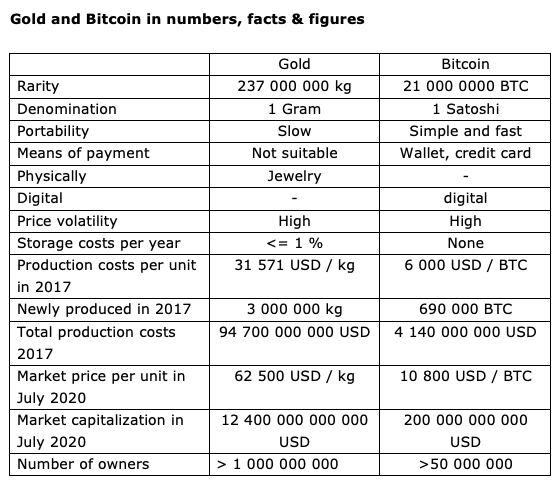

Gold is rare, as is Bitcoin

Gold is rare, beautiful to look at and you can make jewelry out of it. That’s why people have thought it valuable for millennia. But when the going gets tough, people are not fed up with gold. And because of its physical denomination and weight, gold is neither easy nor quick to transport or trade. Try to pay for a bicycle as the owner of 1 kilogram gold bar. You would have to melt the gold bar, take the appropriate amount, etc. In the age of digitalization, gold appears as a relic of the past.

Although you cannot eat bitcoins, but bitcoins are just as rare as gold. Currently more than 18.4 million bitcoins have been generated, but in the long run the bitcoin volume is limited to 21 million. This is similar to gold. Around 198.5 million kilograms of gold have been mined worldwide. According to experts, a maximum of additional 48 million kilograms of gold can be produced.

“Gold is a relic from the past.”

Bitcoin is easy to use and you can pay with it

Unlike gold, bitcoins are much easier to piece and transfer. The smallest Bitcoin denomination is 1 Satoshi. This corresponds to 0.00000001 Bitcoin. Bitcoin and Satoshi can be transferred in seconds between anywhere in the world. Even bicycles can now be paid online and offline with Bitcoin at some retailers. And even if a merchant does not accept Bitcoin, there are now Bitcoin-based credit cards that allow you to pay in virtually every major FIAT currency (USD, EUR, Pounds, …). The Bitcoin-FIAT exchange is done by the providers of these credit cards completely automatically in the background.

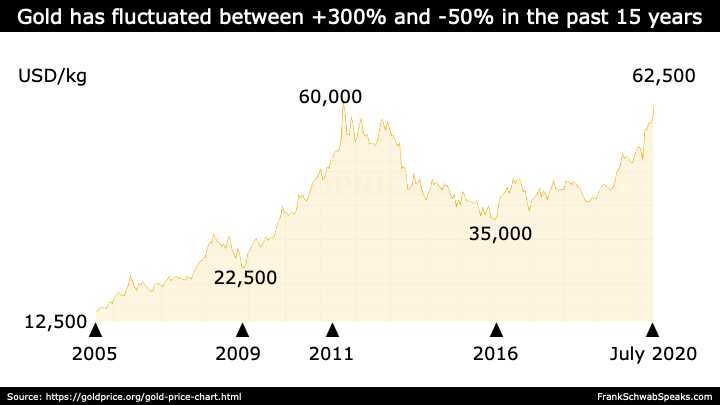

The price of gold also fluctuates strongly

Often the Bitcoin is heavily criticized because of its price volatility. And the facts confirm this criticism. In the past five years, the price initially increased a hundredfold and has fallen again by three quarters since its high of almost USD 20,000 in December 2017. However, if one observes the last 12 months, a decline in the wide fluctuation range can be seen. For a long time, the price of a Bitcoin fluctuated between USD 5,000 and USD 12,500. – This is comparable to other asset classes, such as stocks.

If we take a longer perspective on gold, parallels can be shown. Since 1974, the gold price has increased 25-fold from USD 2,500/kg to USD 62,500/kg.

The fluctuations in gold and bitcoin are therefore quite similar, albeit in different time periods.

Despite high volatility, Bitcoin appears to be a useful and practical alternative to store value in countries with very high inflation rates, such as Venezuela, Ukraine or South Sudan, alongside FIAT currencies.

It is 20 times more expensive to produce gold than to produce bitcoin

According to the World Gold Council, up to 3,000 tons of gold are mined annually worldwide. At an average cost of USD 31,571 per kilo of gold produced, the total cost of the year is USD 94.7 billion.

For 2017, the average cost of producing a new bitcoin is USD 6,000. With 690,000 newly generated bitcoins, this adds up to USD 4.14 billion in total costs.

This means that the cost of producing gold in 2017 was 20 times more expensive than that for bitcoin.

In my opinion, this result puts the current discussion about Bitcoin’s energy consumption into another light. Although high, significantly lower compared to gold. Even with gold, energy consumption is the main cost driver of the total costs.

Also, annual storage costs are to be regarded with Gold or Bitcoin as investment forms. For gold, this can amount to up to 1% of gold wealth annually. For example, if you store your gold at a specialized and professional custodian in Switzerland or Singapore, and not in the in-house vault. The safekeeping of Bitcoins is usually still free of charge, whether in your own wallet or at a crypto exchange.

Gold and Bitcoin in numbers, facts & figures

Fair value of Bitcoin over USD 400,000

In the event that humanity accepts bitcoin as a digital asset in the future, as does gold today, then it is interesting to find a fair value for bitcoin. From my point of view, the market capitalization of gold is a starting point for the future fair value of Bitcoin.

The current market value of the 198.5 million kilograms of gold is USD 12,400 billion. If this market value is spread over the current more than 18.4 million bitcoins, then this results in a price of USD 672,000 per Bitcoin.

It’s hard to predict how long it takes for a similar number of people to own Bitcoin, as does Gold today. Currently, about 50 million people own Bitcoin, while one can assume that more than 1 billion people own gold in the form of jewelry, coins or securities. But you can make estimates. The conditions for a comparatively fast spread are good, because actually it only needs a smartphone and a Bitcoin wallet.

Full coverage of Bitcoin over the next 5 to 15 years is conceivable

On the one hand, there are already more than 2 billion smartphones worldwide, with a strong growth.

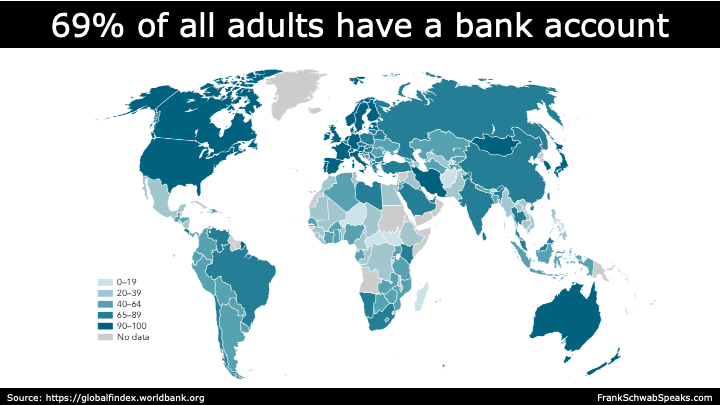

On the other hand, more than 1.2 billion bank accounts were opened between 2011 and 2017, according to the World Bank’s Global Findex database. Worldwide, it is estimated that two-thirds of all adults have a bank account. Thus the second condition for the basic understanding of the humans for the banking and a Bitcoin Wallet is created.

“Together, these two developments will make it possible for Bitcoin to be widely distributed worldwide over the next 5 to 15 years.”

Should the Bitcoin actually develop into digital gold, then further, enormous increases in value are to be expected. It’s not about Bitcoin replacing gold. But Bitcoin creates a new, additional asset class. And I therefore expect Bitcoin to establish itself as a digital asset in the wallets and portfolios of hundreds of millions of people in the not-too-distant future.

Links

https://www.slideshare.net/ashridge/bitcoin-gold-of-the-future-update-july-2020-237408131

https://globalfindex.worldbank.org

https://digiconomist.net/bitcoin-energy-consumption

https://www.americanbullion.com/the-cost-of-producing-an-ounce-of-gold/

https://www.bitcoinmarketjournal.com/how-many-people-use-bitcoin/

- Bitcoin – Gold of the Future – Update July 2020 - July 30, 2020

I am actually really optimistic about bitcoin. You can see that in the last few years the number of investors who turned to bitcoin increased dramatically. Also, the number of both giant companies like Sfox and smaller brokers like this one https://thejingstock.com/ keep entering the market every day which means there is a demand. Imo there is a bright future for crypto in the next 5-10 years.