IFRS 3 — “Business Combinations”- Auditors Approach

By Adil Khan

Manager Audit and Assurance Services,Mazars Abu Dhabi, UAE

IFRS 3 and IFRS 10 are the most complicated standards for the audit profession (complex groups) and supplements each other. This article should not be used as guidelines to be regurgitated in all cases and to when an entity should apply IFRS 3 or IFRS 10 or what is the difference between “IFRS 3 “Business Combinations” and “IFRS 10 “Consolidated Financial Statements”.

More particularly, IFRS 3 Business Combination focuses on how the acquirer:

- Recognizes and measures the identifiable assets acquired, the liabilities assumed and any non-controlling interest (NCI)in the acquiree.

- Recognizes & measures the goodwill acquired in the business combination, or a gain from a bargain purchase.

- Determines what information to discloseabout the business combination.

IFRS 3 only applies, when the transaction is a Business Combination.

IFRS 3 requires that assets and liabilities acquired need to constitute a business, otherwise it’s not a business combination and an investor needs to account for the transaction in line with other IFRSs (i-e IAS 16, IAS 38 and etc..).

What is Business in term of IFRS 3 Business Combination?

Going to the standard definition below, it seems simple & easy that business means anything with below three characteristics (and would fall under IFRS 3):

- Input= any economic resource that creates or can create outputs when process applied to it, e.g. non-current assets (Property, Plant and Equipment), etc.

- Process= any system, standard, protocol or rule that when applied to an input(s), creates outputs, e.g. management processes, procedures, and workforce, etc.

- Output= the result of inputs and processes applied to those inputs that provide (or can provide) a return. e.g. dividends, reducing costs or any economic benefits to investors/owners.

In term of the above definition, we can say it is very easy, but I would say, it is not.

I personally encountered many instances in respect to acquisition, which was very complex and judgmental in ascertaining whether the transaction or event is a business combination and it meets the definition of the business as per IFRS 3.

This article listed number of illustrations/practical scenario below that would help audit profession/entities in determining whether the transaction/event is the business combination or not (whether it meets the definition of business as above).

Example 1—Acquisition of Real Estate Business by the Audit client

Scenario 1—Background of transaction

As an “Audit In-charge”, the team requires your technical advice on the scenario where the audit client (the “acquirer”) purchases a portfolio of 10 single-family homes that each have an in-place lease

The fair value of the consideration paid is equal to the aggregate fair value of the 10 single-family homes acquired. Each single-family home includes the land, building and property improvements. Each home has a different floor area and interior design. The 10 single-family homes are in the same area and the classes of customers (e.g. tenants) are similar. The risks associated with operating in the real estate market of the homes acquired are not significantly different. No employees, other assets, processes, or other activities are transferred.

Explanation to Scenario 1:

It can be concluded from above scenario that as each single-family home is considered a single identifiable asset due to the following reasons (as per IFRS 3):

- the building and property improvements are attached to the land and cannot be removed without incurring significant cost; and

- the building and the in-place lease are considered a single identifiable asset, because they would be recognized and measured as a single identifiable asset in a business combination.

- the group of 10 single-family homes is a group of similar identifiable assets because the assets (all single-family homes) are similar in nature and the risks associated with managing and creating outputs are not significantly different. This is because the types of homes and classes of customers are not significantly different.

Consequently, substantially all the fair value of the gross assets acquired is concentrated in a group of similar identifiable assets.

Hence, that above set of activities and assetsis not a business and never covers under IFRS 3 Business Combinations.

Scenario 2—Background of transaction

Assume the same facts as in Scenario 1 except that audit client also purchases a multi-tenant corporate office park with seven 15-storey office buildings that are fully leased.

The additional set of activities and assets acquired includes the land, buildings, leases and contracts for outsourced cleaning, security and maintenance. No employees, other assets, other processes or other activities are transferred. The aggregate fair value associated with the office park is similar to the aggregate fair value associated with the 10 single-family homes. The processes performed through the contracts for outsourced cleaning and security are minor to all the processes required to create outputs.

Explanation to Scenario 2:

The single-family homes and the office park are not similar identifiable assets because the single-family homes and the office park differ significantly in the risks associated with operating the assets (obtaining tenants and managing tenants). Their customers are different. Consequently, the fair value of the assets acquired is not substantially all concentrated in a group of similar identifiable assets, because the fair value of the office park is like the aggregate fair value of the 10 single-family homes.

Focus the above transaction, it has its outputs, because it generates revenue through the in-place leases. However, the transaction does not include workforce, plus it can be seen that the process performed by outsourced cleaning, security and maintenance personnel are only ancillary to process in order to create any output and are not critical to the output itself.

As an audit professional it should be noted that, after considering the only processes acquired, those performed by the outsourced cleaning, security and maintenance personnel.

We can conclude that the processes do not majorly contribute to producing outputs and the processes can be readily accessible in the market. Thus, they are not unique or scarce. In addition, they could be replaced without significant cost, effort, or delay.

Consequently, it can be concluded that the acquired set of activities and assets defined in scenario 2 is not a business.

Scenario 3—Background of transaction

Now, making some minor changes/addition to the scenario 2 above, for instance:

As an auditor you have encountered the above scenario and assumed the same facts as in scenario 2, except that the acquired set of activities and assets also includes the employees responsible for leasing, tenant management, and managing and supervising all operational processes.

Explanation:

It can be assess now that also the acquired set of activities and assets has outputs because it generates revenue through the in-place leases and also the transaction includes an organized workforce with the necessary skills, knowledge or experience to perform processes that are substantive because they are critical to output now

Having said this, we can conclude that the acquired set of activities and assets is a business and should be treated by the audit client under IFRS 3 Business Combination.

Example 2—Acquisition of a Biotech Entity by the Audit Client

Background of transaction

As an In-charge of audit, the team requires your technical advice on the scenario where the audit client (acquirer) purchases a legal entity (i-e Biotech). The team needs your opinion, whether the transaction would fall under business combination?

Biotech’s operations include: R&D activities on medicines that it is developing (in-process research and development projects); senior management, technical staff and let say also scientists who have the necessary skills, knowledge and experience to perform R&D activities; and also tangible assets (including a corporate headquarters, a research lab, and equipment).

Biotech does not yet have a marketable product and has not yet generated revenue. Each of the assets acquired has a similar fair value.

Explanation:

It can be evident that the fair value of the gross assets acquired is not substantially all concentrated in a single identifiable asset or group of similar identifiable assets. Thus, the optional concentration test set out would not be met (check IFRS 3 for further understanding pls!).

Let us assess whether it meets the minimum requirements to be considered a business as per the standard.

As an Audit In-charge, you should:

- First assess whether the audit client has acquired any processes. No process is documented.

But the acquired organized workforce has the knowledge and experience of projects. It can be concluded that the intellectual capacity of the workforce with necessary skills and experience provides the necessary processes that can apply to inputs to create outputs.

- Now, it should be assessed whether the acquired process is substantive and critical to the process.

I would say, YES! Because the acquired process is very critical to the ability to develop / convert input to output and more importantly, input acquired include both, workforce with all necessary skills and other inputs that workforce could develop or convert to output (in process R&D projects).

- Hence, concluded that the acquired substantive processes and the acquired inputs together significantly contribute to the ability to create output.

Consequently, the acquired set of activities and assets is a busines and would be covered under IFRS 3 Business Combination.

Example 3—Acquisition of a Television Station by the Audit client

Background of transaction

As an Audit In-charge, the team has asked you for the advice on the scenario where the audit client (acquirer) purchases broadcasting assets from another entity (seller).

The acquired set of activities and assets includes only the communications license, the broadcasting equipment, and an office building. Each of the assets acquired has a similar fair value. Purchaser does not purchase the processes needed to broadcast programs and it does not acquire any employees, other assets, other processes, or other activities. Before the acquisition date, Seller stopped broadcasting using the set of activities and assets acquired by audit client.

Explanation:

As an In-charge of the audit, you;

- Should highlight to the team that the broadcasting equipment and building are not a single identifiable asset because the equipment is not attached to the building and can be removed without significant cost. The license is an intangible asset, while broadcasting equipment and building are tangible. Consequently, the assets are not considered like each other.

- Hence should be concluded by the you that the set of activities and assets does not have outputs, because Seller has stopped broadcasting. This does not include an organized workforce.

Consequently, the acquired set of activities and assets is not a business.

Example 4—Acquisition of a Closed Manufacturing Facility by the Audit Client

Background of transaction

As an Audit In-charge, the team requires your technical advice on the scenario where the audit client (acquirer) purchases a closed manufacturing facility—the land and the building—as well as the related equipment.

The fair value of the equipment and the fair value of the facility are similar. To comply with local laws, acquirer (the audit client) must take over the employees all the employees. No other assets, processes or other activities are transferred in the transaction. The acquired set of activities and assets stopped producing outputs before the acquisition date.

Explanation:

After analyzing the above, you can clearly demonstrate that;

- the equipment could be removed from the facility without significant cost, the equipment is not attached to the facility and can be used in other manufacturing facilities.

- The acquired set of activities and assets does not have outputs at the acquisition date because it stopped producing outputs before then.

- The set includes the workforce that has the necessary skills or experience to use the equipment, but it does not include another acquired input (such as intellectual property or inventories) that the workforce could develop or convert into outputs.

The facility and the equipment cannot be developed or converted into outputs. Hence, the acquired set of activities and assets is not a business and would not fall in to IFRS 3 Business Combination treatment.

Example 5—License of Distribution Rights by the Audit Client

Background of transaction

As an Audit In-charge, the team requires your technical advice on the scenario where the audit client (acquirer) purchases from another entity (Seller) the exclusive sublicence to distribute Product “X” in a specified jurisdiction/cities.

Seller has the license to distribute Product “X” worldwide. As part of this transaction, audit client (the acquiree) also purchases the existing customer contracts in the jurisdiction and takes over a supply contract to purchase Product “X” from the producer (@ market rates).

None of the identifiable assets acquired has a fair value that constitutes substantially all of the fair value of the gross assets acquired. No employees, other assets, processes, distribution capabilities or other activities are transferred.

Explanation:

After analyzing the above, you can clearly demonstrate that the set of activities and assets has outputs because at the acquisition date the license was generating revenue from customers in the jurisdiction specified in sublicense.

As can be seen, acquired contracts are an input and not a substantive process. Purchaser considers next whether the acquired supply contract provides access to workforce that performs a substantive process.

Because the supply contract is not providing a service that applies a process to another acquired input, you can conclude that,

- the substance of the supply contract is only that of buying Product “X”, without acquiring the organized workforce, processes and other inputs needed to produce Product “X”.

- Furthermore, the acquired sublicence is an input, not a process. no substantive process that could be critical to the output.

It is concluded further that the set is not a business because it does not include an organized workforce and audit client has acquired

Example 6—Acquisition of Brands by the Audit Client

Background of transaction

Assume the same facts as in Example E, except that Purchaser purchases the worldwide rights to Product “X”, including all related intellectual property.

The acquired set of activities and assets includes all customer contracts and customer relationships, inventories, marketing, supply, specialized equipment specific to manufacturing Product “X” and the manufacturing processes and tools to produce Product “X”. No employees, other assets, other processes or other activities are transferred.

Explanation:

After analysis of the above, you can clearly demonstrate that,

- The set does not include an organized workforce. However, It can be concluded further that the acquired manufacturing processes are substantive because, when applied to acquired inputs, such as the intellectual property, supply and specialized equipment, those processes mainly contribute to the ability to continue producing outputs and as they are unique to Product “X”.

Furthermore, those critical processes and inputs together mainly contribute to the ability to create output. As a result, the acquired set of activities and assets is a business.

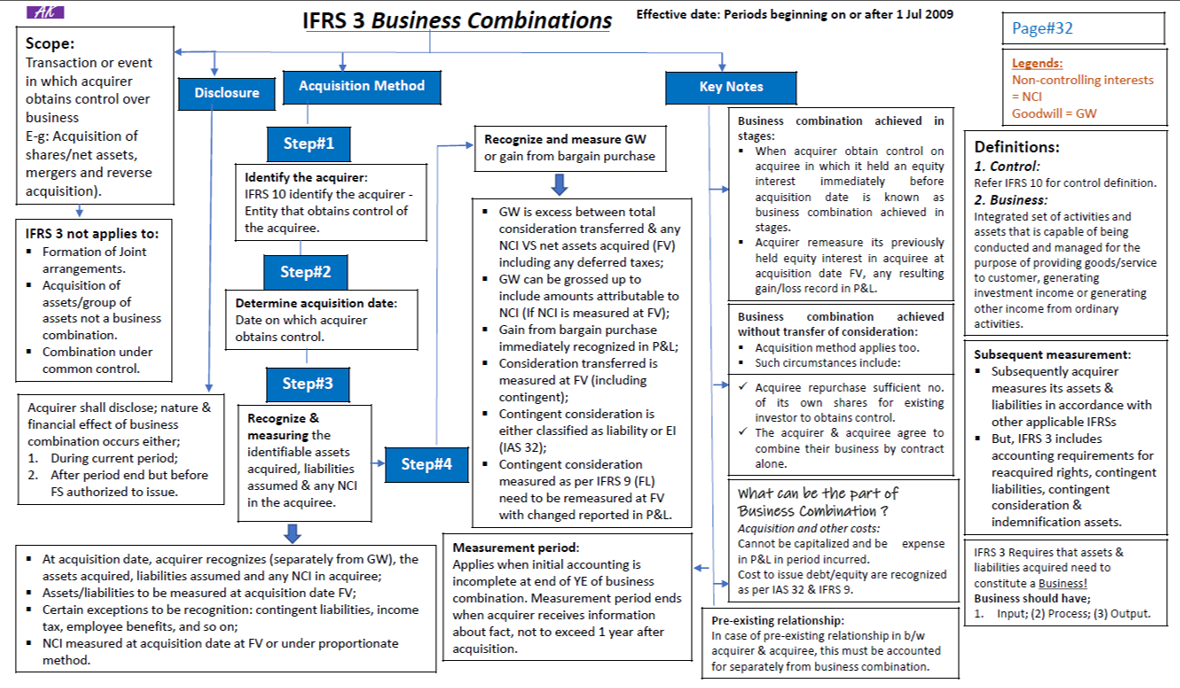

BELOW IS AN EXTRACT OF THE IFRS 3 from thee IFRS Glimpse (IG) published by my-self for the high level overview and understanding.

- Board Reporting Software – Best Practices for Writing a Board Report That Resonates With Members - July 24, 2024

- What Are Data Rooms? - July 21, 2024

- Board Portals for Meetings - July 17, 2024

Stay connected