UAE CT -FTA Published Conditions for Change in Tax Period

UAE CORPORATE TAX UPDATE-FTA publishes decision No 5 of 2023 on the Conditions for Change in Tax Period. The FTA has issued Federal Tax Authority Decision No. 5 of 2023 on the Conditions for Change in Tax Period. This Decision shall be published in the…

UAE CT-Decision on provisions for Exemption from CT

UAE FTA publishes FTA decision No 7 of 2023 on the Provisions of Exemption from Corporate Tax. The Federal Tax Authority (FTA) of the United Arab Emirates (UAE) published FTA Decision No. 7 of 2023 (Decision), delineating certain procedures for registration and application for exemption…

UAE CT- TAX GROUPS AND QUALIFYING GROUPS

UAE CORPORATE TAX – QUALIFYING GROUP AND TAX GROUP Large businesses often conduct their operations through a group of companies, which has a parent company and a number of subsidiaries. By forming a corporate tax group in the UAE, businesses can also enjoy benefits such…

HOW TO CALCULATE TAXABLE INCOME-UAE CORPORTAE TAX

On December 9, 2022, Federal Tax Authority (the FTA) issued Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Business (the CT Law). According to this law, businesses will become subject to UAE Corporate tax from the beginning of their first financial…

UAE CORPORATE TAX UPDATE-Tax Relief to Support Small Businesses

Tax Relief to Support Small Businesses The United Arab Emirates will soon be introducing Corporate Tax, effective for financial years starting on or after 1 June 2023, applicable on the net profit of companies or other businesses in accordance with Federal Law No.47 of 2022…

WHY INTERNAL CONTROL OVER FINANCIAL REPORTING (ICFR) IS IMPORTANT

WHY (ICFR) INTERNAL CONTROL OVER FINANCIAL REPORTING IS IMPORTANT Recently Credit Suisse Group, still reeling from significant losses tied to the 2021 collapses of Archegos Capital Management and Greensill Capital, disclosed in its annual report its internal control over financial reporting (ICFR) was “not…

How to Liquidate Company in the UAE?

How to Liquidate Company in the UAE? By Alia Noor, FCMA, CIMA, MBA, Oxford fintech programme, GCC VAT Comp Dip,COSO Framework. Associate Partner Ahmad Alagbari Chartered Accountants, UAE Founder xpertsleague The legal procedure by which the corporate life of a company is brought to…

The Game of Chess and Business

“The Game of Chess and Business” By Alia Noor, FCMA, CIMA, MBA, Oxford fintech programme, GCC VAT Comp Dip,COSO Framework. Associate Partner Ahmad Alagbari Chartered Accountants, UAE Founder xpertsleague Game of chess is a Mind Game and you have a picture of how the…

Unlearn What is UnTrue!

Unlearn What is UnTrue! Human mind does an excellent job of this, for most things. No special technique is required. When a datum is believed to be true the mind will label it as true. Once the mind recognizes that which is false, no…

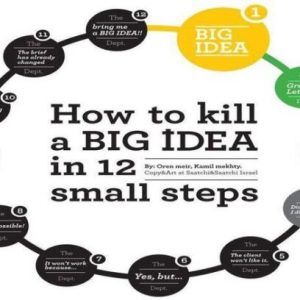

Big ideas are so hard to recognize, so fragile, so easy to kill.

How to kill a big idea in 12 small steps! Big ideas are so hard to recognize, so fragile, so easy to kill. Big ideas, big ambitious projects need to be embedded within culture .These ideas come from forward thinking people who…

Stay connected