IFRS 16 lease Accounting- Changes Implementation and Compliance for Companies.

By Alia Noor, FCMA, CIMA, MBA, Oxford fintech programme, GCC VAT Comp Dip,COSO Framework.

Associate Partner Ahmad Alagbari Chartered Accountants, UAE

Founder xpertsleague

IFRS 16 became effective for annual periods beginning on or after 1 January 2019 with early application permitted. IFRS 16 replaces IAS 17 – Leases and related interpretations.

It introduced significant changes to the lessee model in that it requires lessees to recognise assets and liabilities for all leases except those whose term is less than 12 months or when the underlying asset is of low value.

IFRS 16 substantially carries forward the lessor accounting requirements in IAS 17. Accordingly, a lessor continues to classify its leases as operating leases or finance leases, and to account for those two types of leases differently.

In May 2020, IASB issued amendment of IFRS 16 Leases and introduce an optional practical expedient that simplifies how a lessee accounts for rent concessions that are a direct consequence of COVID-19.

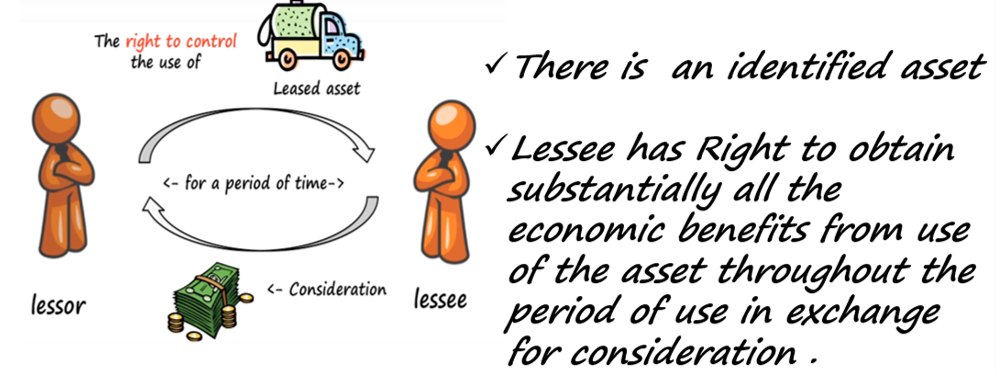

1-Definition of a lease under IFRS 16

A lease is defined as a “contract” which conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

There are two important elements to this:

“Identified asset” In most cases, the asset is identified if it is explicitly specified – e.g. referred to by name in a contract. Depending on the circumstances, if the supplier has the right to substitute the asset during the period of use, it may not be deemed as ‘identified’.

“Control”The question of control is decided on whether the lessee has the right to obtain “all of the economic benefits” from use of the asset and the right to direct its use.Broadly, if you can decide how and for what purposes the asset is used, you have control over it.

2-IFRS 16 for contracts – Having with both Lease and Service Components

Under IFRS 16 at inception of a contract, an entity shall assess whether the contract is, or contains, a lease.

Some contracts include the right to use an asset (the lease component) in addition to the provision of services connected to that asset (the service component).

The contractual terms must be carefully examined in order to determine the duration of the contract (depending on any exit or extension clauses) or the existence of ‘service’ components that must be separately accounted and will remain off-balance sheet.

3-IFRS 16 Provides Two Optional Exemption

IFRS 16 allows a lessee to elect not to apply the recognition requirements to:

a) Short-term leases; lessees may elect not to recognize assets and liabilities for leases with a lease term of 12 months or less. The exemption is required to be applied by class of underlying assets.

b) Leases for which the underlying asset is of low value; Lessees are not required to recognize assets or liabilities for leases of low value assets such as tablets and personal computers, small items of office furniture and telephones

Value of an underlying asset is based on the value of the asset when it is new, regardless of the age of the asset being leased.

4-An uptick in Finance leases and the Elimination of the Operating lease classification

The IFRS 16 introduces a “single lessee accounting model” where a “lessee will no longer make a distinction between finance leases and operating leases”.

As a result, all leases must now be treated in the way that finance leases are treated under IAS 17 except for those that meet the practical expedient for low value/short-term leases. Lessors are required to show a lease receivable and a future flow in income (at NPV) for each lease.

Due to the elimination of the operating lease classification,

lessees must now report all leases using right-of-use (ROU) as “asset” and lease liabilities under IFRS 16.

5-Financial Reporting Principles for Lease under IFRS 16

“Lessees – Principles of Accounting for Lease”

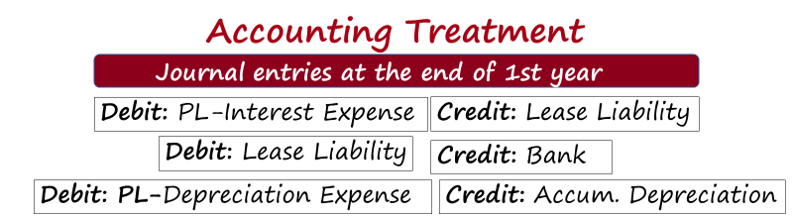

In the statement of financial position, the lessee will recognize the asset and the liability for the lease, while in the statement of profit and loss, the lessee will recognize the interest cost and the depreciation of the leased asset instead of the operating lease expenses.

In lessee-side approach, The right of use by the contract must be recognized as an “Asset”and the debt of the contract must be recognized as a “liability”.

Initial Recognition:

A ‘right-of-use’ model replaces the ‘risks and rewards’ model. Lessees are required to recognize an asset and liability at the inception of a lease.

At lease commencement, a lessee accounts for two elements:

1- Right-of-use asset:

Initially, a right-of-use asset is measured in the amount of the lease liability and initial direct costs.Then it is adjusted by the lease payments made before or on commencement date, lease incentives received, and any estimate of dismantling and restoration costs (remember IAS 37).

2- Lease liability:

The lease liability is in fact all payments not paid at the commencement date discounted to present value using the interest rate implicit in the lease (or incremental borrowing rate if the previous one cannot be set).These payments may include fixed payments, variable payments, payments under residual value guarantees, purchase price if purchase option will be exercised, etc.

Subsequent measurement:

Subsequently after the commencement date, a lessee shall measure the right-of-use asset and liability. After commencement date, lessee needs to take care about both elements recognized initially:

1-Right-of-use asset:

- Normally, a lessee needs to measure the right-of-use asset using a “cost model” under IAS 16 Property, Plant and Equipment.It basically means to depreciate the asset over the lease term:

- However, the lessee can apply also IAS 40 Investment Property (if the right-of –use asset is an investment property and fair value model is applied),

- or using revaluation model under IAS 16 (if right-of-use asset relates to the class of PPE accounted for by revaluation model).

2-Lease Liability:

After the commencement date, a lessee shall measure the lease liability by:

- Reducing the carrying amount to reflect the lease payments made;

- Reducing the carrying amount to reflect the lease payments made;

- Re-measuring the carrying amount to reflect any reassessment or lease modifications or to reflect revised in-substance fixed lease payments

- Variable lease payments that have not been included in the initial measurement of the lease liability are recognized in the period in which the event or condition that triggers the payments occurs.

Financial Statement – Lessee Presentation:

“Balance Sheet”

Right-of-use assets presented either:

- Separately from other assets (e.g., owned assets)

- Together with other assets as if they were owned, with disclosures of the balance sheet line items that include right-of-use assets and their amounts.

- Right-of-use assets that meet the definition of investment property are presented as investment Property.

Lease liabilities presented either:

- Separately from other liabilities

- Together with other liabilities with disclosure of the balance sheet line items that include lease liabilities and their amounts.

“Statement of Profit or loss”

- Lease-related depreciation and lease-related interest expense are presented separately (i.e., lease-related depreciation and lease-related interest expense cannot be combined).

- Interest expense on the lease liability is a component of finance costs.

“Statement of Cash Flows”

- Cash payments for the principal portion of the lease liability are presented within financing activities

- Cash payments for the interest portion of the lease liability are presented based on an accounting policy election in accordance with IAS 7 Statement of Cash Flows

- Lease payments for short-term leases and leases of low-value assets not recognized on the balance sheet and variable lease payments not included in the lease liability are presented within operating activities

- Non-cash activity (e.g., the initial recognition of the lease at commencement) is disclosed as a supplemental non-cash item

“Lessor- Principles of Accounting for Lease”:

Lessor accounting remains similar to current practice.Lessors need to classify the lease as either operating or finance. The accounting treatment depends on the type of the lease:

Finance lease: Lessor initially recognizes the receivable equal to net investment in the lease. Subsequently finance income is recognized in profit or loss.

Operating lease: Lessor recognizes the lease payments received as income in profit or loss.

6-Impact of IFRS 16- Financial Ratios of Lessee

Performance measures such as operating profit, EBIT, EBITDA and operating cash flows reported would improve. However some financial ratios and performance metrics will be impacted, such as gearing, current ratio, asset turnover, interest cover, EBIT, operating profit, net income, EPS, ROCE, ROE, and operating cash flows.

7-Effects of the COVID-19 –Lease Concessions Related to the Pandemic

In May 2020, IASB issued amendment of IFRS 16 Leases to tackle exactly the rent concessions provided to lessees as a response to the COVID-19 pandemics.

It is a practical expedient and it is voluntary.

However, you need to meet three conditions:

The amendments introduce an optional practical expedient that simplifies how a lessee accounts for rent concessions that are a direct consequence of COVID-19.

A lessee that applies the practical expedient is not required to assess whether eligible rent concessions are lease modifications, and accounts for them in accordance with other applicable guidance.

The resulting accounting will depend on the details of the rent concession.For example, if the concession is in the form of a one-off reduction in rent, it will be accounted for as a variable lease payment and be recognised in profit or loss.

The practical expedient will only apply if:

- Revised consideration must be either the same or less than the consideration before the change;

- The discount on rentals must not go beyond 30 June 2021. Therefore, if your lease term ends in December 2021 and the lessor gives you a discount on ALL payments until December 2021, then you CANNOT apply this expedient on ALL the lease.

- No other significant change in terms and conditions of the lease.

Lessees applying the practical expedient are required to disclose:

- that fact, if they have applied the practical expedient to all eligible rent concessions and, if not, the nature of the contracts to which they have applied the practical expedient; and

- the amount recognised in profit or loss for the reporting period arising from application of the practical expedient.

No practical expedient is provided for lessors. Lessors are required to continue to assess if the rent concessions are lease modifications and account for them accordingly.

DISCLAIMER:

This document is only for information purposes and should not be construed as an advice. It does not necessarily cover each aspect of the topic with which it deals. You should not act upon the contents of this document without receiving formal advice on your particular circumstances.

- “𝐇𝐎𝐖 𝐓𝐎 𝐓𝐀𝐌𝐄 𝐘𝐎𝐔𝐑 𝐓𝐀𝐗 𝐃𝐑𝐀𝐆𝐎𝐍” - January 24, 2024

- Generative AI: A powerful tool for CEOs - January 19, 2024

- The Next Wave of Finance Digital Transformation: Unlocking Potential in 2024 - December 7, 2023

Stay connected